The potential of pro-market activism as a tool for making finance work for Africa : A political economy perspective

Dafe, FlorenceDownload:

pdf-Format: Dokument 1.pdf (397 KB)

| URL | http://edoc.vifapol.de/opus/volltexte/2011/3342/ |

|---|---|

| Dokumentart: | Bericht / Forschungsbericht / Abhandlung |

| Institut: | DIE - Deutsches Institut für Entwicklungspolitik |

| Schriftenreihe: | Discussion paper // Deutsches Institut für Entwicklungspolitik |

| Bandnummer: | 2011, 2 |

| ISBN: | 978-3-88985-531-2 |

| Sprache: | Englisch |

| Erstellungsjahr: | 2011 |

| Publikationsdatum: | 05.09.2011 |

| Originalveröffentlichung: | http://www.die-gdi.de/CMS-Homepage/openwebcms3.nsf/(ynDK_contentByKey)/ANES-8DNAK4/$FILE/DP%202.2011.pdf (2011) |

| SWD-Schlagwörter: | Politisches Handeln , Subsaharisches Afrika , Finanzwirtschaft , Investition |

| DDC-Sachgruppe: | Politik |

| BK - Basisklassifikation: | 83.46 (Entwicklungsökonomie), 83.52 (Finanzwissenschaft), 89.59 (Politische Prozesse: Sonstiges) |

| Sondersammelgebiete: | 3.6 Politik und Friedensforschung |

Kurzfassung auf Englisch:

Under what conditions can government interventions in the financial sector be a successful tool to increase the financial resources available for productive investment in sub-Saharan Africa? This is the question which drives this paper. The relevance of research on this issue is widely acknowledged: There is strong empirical evidence that access to finance for private investment is essential for enterprise development and economic growth. However, most financial systems in sub-Saharan Africa are highly exclusive and poorly developed in terms of size and efficiency. The lack of financial intermediation into higher levels of domestic investment primarily results from market failures which make the provision of financial services to small and medium enterprises (SMEs) prohibitively costly or unattractive. Historically and in line with welfare economic theory market failures have provided an argument for activism, defined as deliberate government interventions in the financial sector to promote the delivery of financial services to segments of the private sector that are underserved. The experience with activism has been mixed at best. However, even though activism does not guarantee an increase in broad-based productive private investment, past experience suggests that achieving this goal without deliberate government interventions is difficult, if not impossible. For this reason there is a renewed interest in the question of how far government interventions in financial markets could promote finance for development. This paper makes three main arguments.

Für Dokumente, die in elektronischer Form über Datenenetze angeboten werden, gilt uneingeschränkt das Urheberrechtsgesetz (UrhG). Insbesondere gilt:

Einzelne Vervielfältigungen, z.B. Kopien und Ausdrucke, dürfen nur zum privaten und sonstigen eigenen Gebrauch angefertigt werden (Paragraph 53 Urheberrecht). Die Herstellung und Verbreitung von weiteren Reproduktionen ist nur mit ausdrücklicher Genehmigung des Urhebers gestattet.

Der Benutzer ist für die Einhaltung der Rechtsvorschriften selbst verantwortlich und kann bei Mißbrauch haftbar gemacht werden.

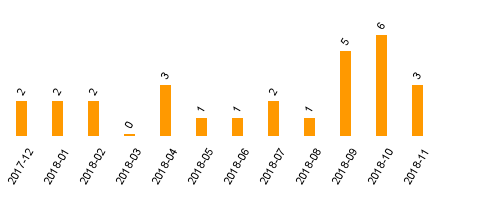

Zugriffsstatistik

(Anzahl Downloads)