International Financial Reporting Standards and banking regulation : a comeback of the state?

Grasl, MaximilianDownload:

pdf-Format: Dokument 1.pdf (689 KB)

| URL | http://edoc.vifapol.de/opus/volltexte/2013/4214/ |

|---|---|

| Dokumentart: | Bericht / Forschungsbericht / Abhandlung |

| Institut: | SFB 597 Staatlichkeit im Wandel |

| Schriftenreihe: | TranState working papers |

| Bandnummer: | 158 |

| Sprache: | Englisch |

| Erstellungsjahr: | 2011 |

| Publikationsdatum: | 11.01.2013 |

| Originalveröffentlichung: | http://www.sfb597.uni-bremen.de/pages/download.php?ID=199&SPRACHE=DE&TABLE=AP&TYPE=PDF (2011) |

| SWD-Schlagwörter: | Finanzkrise , Internationaler Kreditmarkt , Regulierung , International Reporting Standards |

| DDC-Sachgruppe: | Politik |

| BK - Basisklassifikation: | 89.73 (Europapolitik, Europäische Union), 88.11 (Zentrale staatliche Verwaltung), 85.25 (Betriebliches Rechnungswesen) |

| Sondersammelgebiete: | 3.6 Politik und Friedensforschung, 3.7 Verwaltungswissenschaften |

Kurzfassung auf Englisch:

The European Union began using accounting rules defined by an independent private sector regime as compulsory norms in 2005. Is the incorporation of these International Financial Reporting Standards (IFRS) into European law a viable solution to combine external technical expertise with principles of democratic governance? The current financial crisis has shown that the technical expertise of this standardsetting body alone does not sufficiently guarantee satisfactory policy outcomes: The pro-cyclical IFRS-accounting standards have come to be accused of exacerbating the extent of the financial write-offs, which cost an enormous amount of taxpayers money. In consequence, these standards have lost their output legitimacy. Abandoning public competences and legitimate decision-making have not paid off. What does the global public do about this? As early as 2007 the three most important financial jurisdictions (U.S., EU, Japan) and the International Organization of Securities Commissions (IOSCO) urged the IASC Foundation to alter its governance structure in order to enhance public accountability of the International Accounting Standards Board (IASB). How has the relationship of independent but widely influential standard-setters and public authorities developed? While public authorities (especially from the EU) bemoan a loss of public governance in accounting-policy the IASB shows little will to abandon obtained competencies. Public authorities rather have to act strategically in order to retrieve competences within the interwoven field of international financial regulation. The analysis has implications for regime theory, European governance and global political economy of financial regulations.

Für Dokumente, die in elektronischer Form über Datenenetze angeboten werden, gilt uneingeschränkt das Urheberrechtsgesetz (UrhG). Insbesondere gilt:

Einzelne Vervielfältigungen, z.B. Kopien und Ausdrucke, dürfen nur zum privaten und sonstigen eigenen Gebrauch angefertigt werden (Paragraph 53 Urheberrecht). Die Herstellung und Verbreitung von weiteren Reproduktionen ist nur mit ausdrücklicher Genehmigung des Urhebers gestattet.

Der Benutzer ist für die Einhaltung der Rechtsvorschriften selbst verantwortlich und kann bei Mißbrauch haftbar gemacht werden.

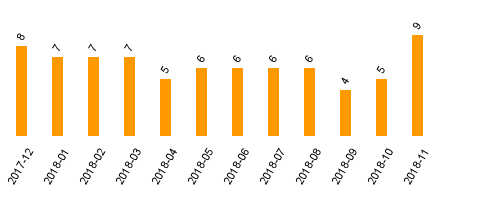

Zugriffsstatistik

(Anzahl Downloads)