Innovations in Government Accounting : The Case of Australia in a Westminster Context

Steller, DirkDownload:

pdf-Format: Dokument 1.pdf (928 KB)

| URL | http://edoc.vifapol.de/opus/volltexte/2010/2270/ |

|---|---|

| Dokumentart: | Bericht / Forschungsbericht / Abhandlung |

| Institut: | Zentrum für Verwaltungsmanagement an der Uni Innsbruck |

| Schriftenreihe: | Working paper // Universität Innsbruck, Zentrum für Verwaltungsmanagement |

| Bandnummer: | 3 |

| Sprache: | Englisch |

| Erstellungsjahr: | 2003 |

| Publikationsdatum: | 11.11.2010 |

| Originalveröffentlichung: | http://www.verwaltungsmanagement.at/602/uploads/10650090900.pdf (2003) |

| DDC-Sachgruppe: | Öffentliche Verwaltung |

| BK - Basisklassifikation: | 88.70 (Vergleichende Verwaltungslehre), 88.60 (Politische Maßnahmen), 88.20 (Organisation staatlicher Einrichtungen, Management staatlicher Einrichtungen), 88.10 (Öffentliche Verwaltung: Allgemeines) |

| Sondersammelgebiete: | 3.7 Verwaltungswissenschaften |

Kurzfassung auf Englisch:

Government accounting and other financial management practices have in recent times become one of the major target areas of public management reform. Public sector organisations traditionally use accounting systems based on cash inflows and cash outflows, commonly known as cash accounting. This cash style of accounting differs significantly from accounting systems used in the private sector, so called accrual accounting systems. The recent reforms to government accounting systems have focused largely on implementing accrual accounting in the public sector. The exponents of accrual accounting argue that it provides significantly more detailed and accurate financial information than cash systems. One of the basic principles of accounting and financial reporting is that it should provide a true and fair view of the financial operations and financial position of an entity. Given that cash accounting records cash transactions only, no consideration is given to assets and liabilities or to items extending beyond the accounting period (i.e. prepayments and accrued expenses). Accrual accounting on the other hand produces detailed information on assets and liabilities and requires depreciation expenses to be matched to the expected life of the related asset. Similarly, accruing expenses such as employee entitlements are represented in the financial reports. Countries with a Westminster style of government have tended to be the leaders in implementing accrual accounting in the public sector. This research paper provides a detailed description and analysis of the financial reforms undertaken in the Australian Commonwealth public sector.

Für Dokumente, die in elektronischer Form über Datenenetze angeboten werden, gilt uneingeschränkt das Urheberrechtsgesetz (UrhG). Insbesondere gilt:

Einzelne Vervielfältigungen, z.B. Kopien und Ausdrucke, dürfen nur zum privaten und sonstigen eigenen Gebrauch angefertigt werden (Paragraph 53 Urheberrecht). Die Herstellung und Verbreitung von weiteren Reproduktionen ist nur mit ausdrücklicher Genehmigung des Urhebers gestattet.

Der Benutzer ist für die Einhaltung der Rechtsvorschriften selbst verantwortlich und kann bei Mißbrauch haftbar gemacht werden.

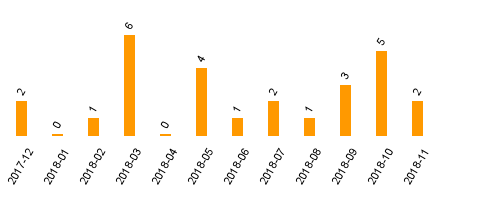

Zugriffsstatistik

(Anzahl Downloads)