The political economy of bilateralism and multilateralism : institutional choice in international trade and taxation

Rixen, Thomas ; Rohlfing, IngoDownload:

pdf-Format: Dokument 1.pdf (642 KB)

| URL | http://edoc.vifapol.de/opus/volltexte/2012/4072/ |

|---|---|

| Dokumentart: | Bericht / Forschungsbericht / Abhandlung |

| Institut: | SFB 597 Staatlichkeit im Wandel |

| Schriftenreihe: | TranState working papers |

| Bandnummer: | 31 |

| Sprache: | Englisch |

| Erstellungsjahr: | 2005 |

| Publikationsdatum: | 12.12.2012 |

| Originalveröffentlichung: | http://www.sfb597.uni-bremen.de/pages/download.php?ID=34&SPRACHE=DE&TABLE=AP&TYPE=PDF (2005) |

| SWD-Schlagwörter: | Welthandel , Wirtschaftsbeziehungen , Multilateralismus |

| DDC-Sachgruppe: | Politik |

| BK - Basisklassifikation: | 83.71 (Handel), 83.49 (Außenwirtschaft: Sonstiges), 89.70 (Internationale Beziehungen: Allgemeines) |

| Sondersammelgebiete: | 3.6 Politik und Friedensforschung |

Kurzfassung auf Englisch:

Trade relations are governed by the multilateral GATT, whereas the avoidance of international double taxation rests on a network of around 2000 bilateral treaties. Given the two regimes’ similar economic rationales this difference between bilateralism in international double tax avoidance and multilateralism in the trade regime poses an empirical puzzle. In this paper we develop an answer to this puzzle. Differentiating between different stages of international cooperation, we first describe the institutional form in the bargaining and agreement stages of cooperation. This description shows that the regimes are quite similar in the bargaining stage, both exhibiting a mix of bilateral and multilateral bargaining. However, while agreement is multilateral in the trade regime it is bilateral in taxation. Based on stylized institutional histories of both cases we develop simple game theoretic models incorporating domestic level considerations. Building on these models we then go on to explain the institutional choice between bilateral and multilateral cooperation. We show that state concerns for the distribution of benefits can be best achieved under bilateral bargaining in both regimes. However, in order to lower transaction costs there are also elements of multilateral bargaining. Agreement is multilateral in trade in order to overcome a free-rider problem that results from an interaction of concerns for distribution and enforcement. Since such a problem of free-riding does not exist in taxation, there is no need for binding multilateral agreement.

Für Dokumente, die in elektronischer Form über Datenenetze angeboten werden, gilt uneingeschränkt das Urheberrechtsgesetz (UrhG). Insbesondere gilt:

Einzelne Vervielfältigungen, z.B. Kopien und Ausdrucke, dürfen nur zum privaten und sonstigen eigenen Gebrauch angefertigt werden (Paragraph 53 Urheberrecht). Die Herstellung und Verbreitung von weiteren Reproduktionen ist nur mit ausdrücklicher Genehmigung des Urhebers gestattet.

Der Benutzer ist für die Einhaltung der Rechtsvorschriften selbst verantwortlich und kann bei Mißbrauch haftbar gemacht werden.

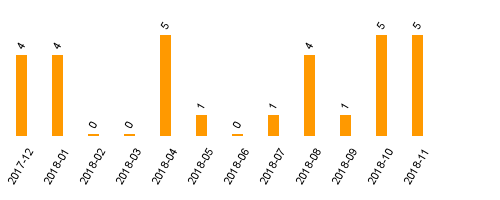

Zugriffsstatistik

(Anzahl Downloads)