Partisanship and taxation : an exploratory study of crisis responses

Lierse, HannaDownload:

pdf-Format: Dokument 1.pdf (673 KB)

| URL | http://edoc.vifapol.de/opus/volltexte/2012/4215/ |

|---|---|

| Dokumentart: | Bericht / Forschungsbericht / Abhandlung |

| Institut: | SFB 597 Staatlichkeit im Wandel |

| Schriftenreihe: | TranState working papers |

| Bandnummer: | 159 |

| Sprache: | Englisch |

| Erstellungsjahr: | 2012 |

| Publikationsdatum: | 23.11.2012 |

| Originalveröffentlichung: | http://www.sfb597.uni-bremen.de/pages/download.php?ID=200&SPRACHE=DE&TABLE=AP&TYPE=PDF (2012) |

| SWD-Schlagwörter: | Steuerpolitik , Politischer Konjunkturzyklus , Wirtschaftskrise , EU-Staaten , Steuer , Finanzkrise , Wirtschaftswachstum |

| DDC-Sachgruppe: | Politik |

| BK - Basisklassifikation: | 83.50 (Geld, Inflation, Kapitalmarkt), 83.31 (Wirtschaftswachstum), 86.73 (Steuerrecht) |

| Sondersammelgebiete: | 3.6 Politik und Friedensforschung |

Kurzfassung auf Englisch:

With the outbreak of the financial crisis in 2008, European governments extensively intervened to avert a severe economic recession. Taxation is a crucial instrument to achieve such economic objectives, but it also represents a redistributive tool in democratic societies. Generally, left-wing parties are more supportive of progressive taxes and redistribution than right-wing governments. As a crisis response, one could assume that European governments, especially social-democrats, reinforced a redistributive stance to compensate for the substantial amounts of public money used to bail-out financial institutions. Yet, the internationalisation of capital markets has made it difficult to levy high income taxes as it might cause capital flights, less investments and growth. Based on the tax reforms introduced between 2008 and 2010, the paper explores how European governments mitigated the fiscal stress from the crisis. The findings show that fiscal pressures significantly restrained the policy choices available to governments.

Für Dokumente, die in elektronischer Form über Datenenetze angeboten werden, gilt uneingeschränkt das Urheberrechtsgesetz (UrhG). Insbesondere gilt:

Einzelne Vervielfältigungen, z.B. Kopien und Ausdrucke, dürfen nur zum privaten und sonstigen eigenen Gebrauch angefertigt werden (Paragraph 53 Urheberrecht). Die Herstellung und Verbreitung von weiteren Reproduktionen ist nur mit ausdrücklicher Genehmigung des Urhebers gestattet.

Der Benutzer ist für die Einhaltung der Rechtsvorschriften selbst verantwortlich und kann bei Mißbrauch haftbar gemacht werden.

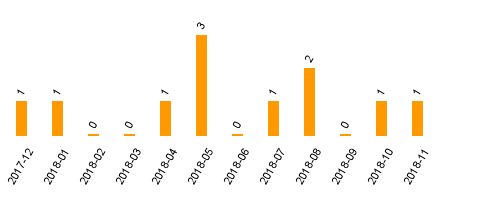

Zugriffsstatistik

(Anzahl Downloads)