Extending coverage of the new pension scheme in India : analysis of market forces and policy options

Stelten, SimoneDownload:

pdf-Format: Dokument 1.pdf (3.072 KB)

| URL | http://edoc.vifapol.de/opus/volltexte/2013/4275/ |

|---|---|

| Dokumentart: | Bericht / Forschungsbericht / Abhandlung |

| Institut: | Hertie School of Governance |

| Schriftenreihe: | Working papers // Hertie School of Governance |

| Bandnummer: | 62 |

| Sprache: | Englisch |

| Erstellungsjahr: | 2011 |

| Publikationsdatum: | 18.01.2013 |

| Originalveröffentlichung: | http://www.hertie-school.org/fileadmin/images/Downloads/working_papers/62_Revised.pdf (2011) |

| SWD-Schlagwörter: | Indien , Rentenversicherung , Marktwirtschaft |

| DDC-Sachgruppe: | Politik |

| BK - Basisklassifikation: | 15.77 (Indischer Subkontinent), 83.21 (Marktwirtschaft), 83.50 (Geld, Inflation, Kapitalmarkt) |

| Sondersammelgebiete: | 3.6 Politik und Friedensforschung |

Kurzfassung auf Englisch:

India has one of the world’s fastest growing economies, but it also has vast structural problems that hinder the country’s socioeconomic development. Most jobs are generated in the informal sector, where more than 80 percent of all workers are employed. Most Indians lack financial resources for retirement and rely on their families, whereas the family is becoming a less reliable source of support in old age due to decreasing fertility and the increasing mobility of the young. Longevity has increased rapidly, while people over 60 years of age are the fastest growing age cohort. Thus, there is a strong need to increase pension coverage for the population that largely consists of informal sector workers. The New Pension Scheme (NPS) was launched by the Government of India in May 2009 to increase pension coverage, particularly to the informal sector. NPS is a voluntary defined contribution scheme, which is distributed through licensed private sector institutions. The Pension Fund Regulatory and Development Authority (PFRDA) in 2010 introduced two further reforms to increase coverage: the “Swavalamban” subsidy for poor workers, and NPS-Lite, which is a means of conducting group enrollments. NPS is distributed through “Points of Presence” (PoPs), which are financial sector institutions, including banks and insurance companies. NPS-Lite is distributed through “aggregators”, which are local institutions including NGOs and selfhelp groups. The current number of 167,002 voluntary subscribers lags far behind its potential. Against this backdrop, the study addresses two research questions. First, why has the NPS approach attracted so few new subscribers until now? Second, which public policy solutions can increase the NPS enrollment rate? The NPS market forces are at the center of the analysis. The study develops its own theoretical framework that consists of a set of criteria to assess the (mis-)match of demand and supply to explain where policy options should be better targeted to address the current low enrollment rates. This study identifies four reasons for low coverage, which show a comprehensive picture of policy shortcomings in terms of all criteria. The scheme does not satisfy the demand for secure financial investments; its legal status and institutional architecture question the long-term stability of scheme and investments; there are severe shortcomings in the management of the scheme’s distribution channels, and a targeted marketing strategy has not been developed, which is necessary to attract the population. This study proposes a policy package of seven short- and long-term measures to increase NPS coverage. The most immediate and largest effects should result from two measures – improving the incentives for the PoPs and developing a targeted pullmarketing strategy. The potential of the proposal is to increase coverage up to 40 million in the medium run (5 years) and there is a vast market of 100 to 130 million persons with sufficient savings capacities in the long run.

Für Dokumente, die in elektronischer Form über Datenenetze angeboten werden, gilt uneingeschränkt das Urheberrechtsgesetz (UrhG). Insbesondere gilt:

Einzelne Vervielfältigungen, z.B. Kopien und Ausdrucke, dürfen nur zum privaten und sonstigen eigenen Gebrauch angefertigt werden (Paragraph 53 Urheberrecht). Die Herstellung und Verbreitung von weiteren Reproduktionen ist nur mit ausdrücklicher Genehmigung des Urhebers gestattet.

Der Benutzer ist für die Einhaltung der Rechtsvorschriften selbst verantwortlich und kann bei Mißbrauch haftbar gemacht werden.

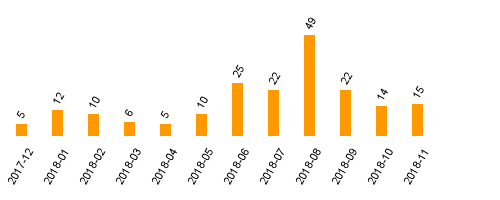

Zugriffsstatistik

(Anzahl Downloads)