The returns on public investment Concepts, evidence and policy challenges

Misch, FlorianDownload:

pdf-Format: Dokument 1.pdf (1.084 KB)

| URL | http://edoc.vifapol.de/opus/volltexte/2011/3272/ |

|---|---|

| Dokumentart: | Bericht / Forschungsbericht / Abhandlung |

| Institut: | DIE - Deutsches Institut für Entwicklungspolitik |

| Schriftenreihe: | Discussion paper // Deutsches Institut für Entwicklungspolitik |

| Bandnummer: | 2008, 25 |

| ISBN: | 978-3-88985-450-6 |

| Sprache: | Englisch |

| Erstellungsjahr: | 2008 |

| Publikationsdatum: | 15.08.2011 |

| Originalveröffentlichung: | http://www.die-gdi.de/CMS-Homepage/openwebcms3.nsf/(ynDK_contentByKey)/ANES-7QXENR/$FILE/DP%2025.2008.pdf (2008) |

| SWD-Schlagwörter: | Staatliche Investitionspolitik , Öffentliche Investition |

| DDC-Sachgruppe: | Politik |

| BK - Basisklassifikation: | 89.55 (Politische Entscheidung), 85.30 (Investition, Finanzierung) |

| Sondersammelgebiete: | 3.6 Politik und Friedensforschung |

Kurzfassung auf Englisch:

Public investment is undoubtedly central for growth and development. In order to make the right decisions on the desirable volume and the most effective allocation of public resources policymakers should know the returns on public investments. Based on this knowledge it would be possible to devise optimal policies, leading to higher growth and poverty reduction. However, in reality, decisions on the volume and allocation of public investments are rarely based on a systematic assessment of their returns. The choice of public investments is rather based on arbitrary decisions in an often intransparent political process. This paper attempts to review the methods of determining the returns of public investment, looks into practical applications of various methods and makes some proposals on how to improve resource allocation in practice, taking into account the difficulties of calculating the returns of public investments ex ante. Correctly measuring the returns on public investment requires the consideration of all costs of public investment and the full impact of public infrastructure on growth. Public infrastructure affects growth through a variety of channels, and the major growthenhancing effects include its impacts on productivity, private investment and human capital. At the same time, public investment may crowd out private investment and may cause Dutch disease effects, which both have a negative impact on growth. The cost associated with public investment includes the capital cost, public adjustment cost and the cost of complementary public expenditure. Effective resource allocation across different public investment projects Given that the returns on different public investment projects likely vary to a considerable extent, careful resource allocation is critical for the effectiveness of public capital expenditure. However, both theoretical and empirical research give few insights for optimal public resource allocation across different sectors and across different public investment projects, and in view of the high degree of complexity, it is not surprising that approaches at the macro and micro level in general fail to determine the exact return of public investment. Calculating the returns ex ante is complex given the difficulty to quantify benefits. In addition, the economic literature provides little guidance. While it suggests that public investment is beneficial in the long run, the usefulness of theoretical models is limited due to parameter uncertainty, and robust and specific ex-post estimates of the returns on public investment with general validity are hardly available. The policy implications include: — A stronger qualitative analysis using a macroeconomic framework Due to the shortcomings of the quantitative micro analysis of the returns on public investment projects because of data and methodological limitations, more effort should be made to improve the qualitative analysis in project appraisals. One way is to use the growth diagnostics framework by Hausmann / Rodrik / Velasco (2008). Even though its application is challenging in practice due to difficulties involved in determining the most binding constraint and the best way to remove it, it certainly enriches the quality of project appraisal. — Further empirical research on the returns on public investment The returns on public investment represent essential information for development policy so that further efforts to obtain better estimates are central. Cross-country regressions unlikely yield higher-quality estimates due to methodological problems and country-specific factors. Therefore, the way forward for empirical research is the use of data that is disaggregated at the sub-national level and the estimation of the effects of public investment at the firm level. Increasing availability of relevant data means that this approach is feasible. — Identification and thorough study of best-practice cases Development agencies should lead efforts to identify and study best-practice cases among developing and developed countries alike. Critical questions that should be answered include how project appraisal is organized in practice, what tools are used for ex ante evaluation and, in particular, what types of public investment projects or other types of growth enhancing public services were financed. Suitable candidates for case studies are countries with a strong economic performance and possibly with much space for discretionary public expenditure policy due to large public revenue from external assistance or from natural resource extraction. Creating fiscal space for public investment A common argument is to create fiscal space for public investment through borrowing because public investment may pay for itself by possibly generating higher future public revenues. However, it must be taken into account that the impact on growth might be small (possibly even negative) due to crowding-out effects, that complementary public spending (e.g. on maintenance) may be required, and that sufficient tax collection capacity is required to ‘capture’ the returns on public investment. Thus, given that the exact returns on public investment are unknown, the IMF/World Bank Debt Sustainability Framework (DSF) does not tell how much extra borrowing to finance public investment is possible without threatening debt sustainability. Several policy implications arise: — The DSF could probably be extended to include more growth scenarios that depend on the way the borrowed funds are used (e.g. a high growth scenario if public investment that targets the most binding constraint is financed). — There are many countries where the risk that additional borrowing worsens debt sustainability should be avoided. These include countries that are in debt distress according to the DSF, countries where low ex-post returns on public investment can be expected due to a variety of reasons and countries where there are other, ‘safer’ ways to create fiscal space. It is strongly recommended to continue research on analytic tools to support a more systematic approach to pro-growth and pro-poor public finances along the lines discussed above. Facing the challenge of decreasing availability of external capital in the aftermath of the financial crisis, it is even more crucial to base the decisions on the allocation of scarce public resources on a more systematic assessment of alternative compositions of public spending.

Für Dokumente, die in elektronischer Form über Datenenetze angeboten werden, gilt uneingeschränkt das Urheberrechtsgesetz (UrhG). Insbesondere gilt:

Einzelne Vervielfältigungen, z.B. Kopien und Ausdrucke, dürfen nur zum privaten und sonstigen eigenen Gebrauch angefertigt werden (Paragraph 53 Urheberrecht). Die Herstellung und Verbreitung von weiteren Reproduktionen ist nur mit ausdrücklicher Genehmigung des Urhebers gestattet.

Der Benutzer ist für die Einhaltung der Rechtsvorschriften selbst verantwortlich und kann bei Mißbrauch haftbar gemacht werden.

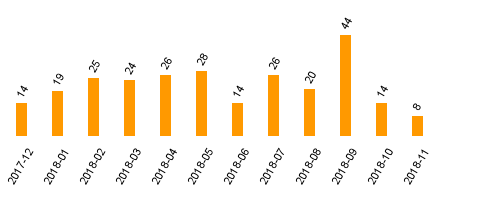

Zugriffsstatistik

(Anzahl Downloads)