Transfer pricing, tax havens and global governance

Bhat, GanapatiDownload:

pdf-Format: Dokument 1.pdf (552 KB)

| URL | http://edoc.vifapol.de/opus/volltexte/2011/3295/ |

|---|---|

| Dokumentart: | Bericht / Forschungsbericht / Abhandlung |

| Institut: | DIE - Deutsches Institut für Entwicklungspolitik |

| Schriftenreihe: | Discussion paper // Deutsches Institut für Entwicklungspolitik |

| Bandnummer: | 2009, 7 |

| ISBN: | 978-3-88985-455-1 |

| Sprache: | Englisch |

| Erstellungsjahr: | 2009 |

| Publikationsdatum: | 14.08.2011 |

| Originalveröffentlichung: | http://www.die-gdi.de/CMS-Homepage/openwebcms3.nsf/(ynDK_contentByKey)/ANES-7SPDBY/$FILE/DP%207.2009.pdf (2009) |

| SWD-Schlagwörter: | Preisbildung , Steueroase , Global Governance , Multinationales Unternehmen , Gewinnverlagerung |

| DDC-Sachgruppe: | Politik |

| BK - Basisklassifikation: | 89.71 (Internationale Zusammenarbeit: Allgemeines) |

| Sondersammelgebiete: | 3.6 Politik und Friedensforschung |

Kurzfassung auf Englisch:

Tax-motivated transfer pricing has attracted world attention owing to the existence of low-tax jurisdictions and the volume of the activities of multinational corporations (MNCs). MNCs have many instruments for shifting profits through transfer pricing, and tax havens provide ample opportunity for this. Tax havens pose the threat of capital flight and income shifting from high-tax countries. At present, there are two ways of tackling this problem: by applying the arm’s length principle to determine the tax payable by MNCs in a particular jurisdiction or by using a formula to allocate tax payable by MNCs between countries. Based on various studies conducted so far, this paper summarizes the advantages and disadvantages of these methods in solving the problem of profit-shifting by MNCs. The predicament is truly global in nature, and no single country or group of countries can hope to resolve it. It is high time a global institution was set up to calculate MNCs’ worldwide income and to provide tax authorities with timely information.

Für Dokumente, die in elektronischer Form über Datenenetze angeboten werden, gilt uneingeschränkt das Urheberrechtsgesetz (UrhG). Insbesondere gilt:

Einzelne Vervielfältigungen, z.B. Kopien und Ausdrucke, dürfen nur zum privaten und sonstigen eigenen Gebrauch angefertigt werden (Paragraph 53 Urheberrecht). Die Herstellung und Verbreitung von weiteren Reproduktionen ist nur mit ausdrücklicher Genehmigung des Urhebers gestattet.

Der Benutzer ist für die Einhaltung der Rechtsvorschriften selbst verantwortlich und kann bei Mißbrauch haftbar gemacht werden.

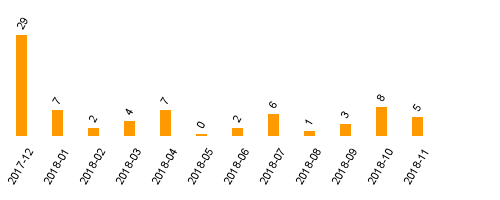

Zugriffsstatistik

(Anzahl Downloads)