Let the good times roll? : Raising tax revenues from the extractive sector in sub-Saharan Africa during the commodity price boom

Stürmer, MartinDownload:

pdf-Format: Dokument 1.pdf (566 KB)

| URL | http://edoc.vifapol.de/opus/volltexte/2011/3315/ |

|---|---|

| Dokumentart: | Bericht / Forschungsbericht / Abhandlung |

| Institut: | DIE - Deutsches Institut für Entwicklungspolitik |

| Schriftenreihe: | Discussion paper // Deutsches Institut für Entwicklungspolitik |

| Bandnummer: | 2010, 7 |

| ISBN: | 978-3-88985-515-2 |

| Sprache: | Englisch |

| Erstellungsjahr: | 2010 |

| Publikationsdatum: | 14.08.2011 |

| Originalveröffentlichung: | http://www.die-gdi.de/CMS-Homepage/openwebcms3.nsf/(ynDK_contentByKey)/MSIN-88MFWX/$FILE/DP%207.2010.pdf (2010) |

| SWD-Schlagwörter: | Steuereinnahmen , Rohstoffwirtschaft , Subsaharisches Afrika |

| DDC-Sachgruppe: | Politik |

| BK - Basisklassifikation: | 83.63 (Volkswirtschaftliche Ressourcen, Umweltökonomie), 74.23 (Afrika), 83.52 (Finanzwissenschaft) |

| Sondersammelgebiete: | 3.6 Politik und Friedensforschung |

Kurzfassung auf Englisch:

High mineral and energy commodity prices shook world commodity markets from 2003 to 2008. Taking three case study countries as examples, this paper shows that sub-Saharan African countries collected only relatively low tax revenues from the extractive sector, unlike such classical mining countries as Australia. Corruption and patronage in the granting of concessions and in tax administration cause low implicit tax rates. Poor conditions impede investments in downstream processing industries and additional production. As a consequence, sales revenues and hence the tax base are relatively lower than in Australia, for example. We present estimates of potential tax revenues for the three case study countries and for sub-Saharan Africa as a whole. Applying Australia’s implicit tax rate to sub-Saharan Africa’s sales revenues, tax revenues in sub-Saharan Africa could have been equivalent to 35 per cent of official development assistance (ODA) from 2003 to 2008. Finally, we suggest some policy options for resource-rich countries and donor countries that may enable tax revenues to be acquired from the extractive sector in the long term.

Für Dokumente, die in elektronischer Form über Datenenetze angeboten werden, gilt uneingeschränkt das Urheberrechtsgesetz (UrhG). Insbesondere gilt:

Einzelne Vervielfältigungen, z.B. Kopien und Ausdrucke, dürfen nur zum privaten und sonstigen eigenen Gebrauch angefertigt werden (Paragraph 53 Urheberrecht). Die Herstellung und Verbreitung von weiteren Reproduktionen ist nur mit ausdrücklicher Genehmigung des Urhebers gestattet.

Der Benutzer ist für die Einhaltung der Rechtsvorschriften selbst verantwortlich und kann bei Mißbrauch haftbar gemacht werden.

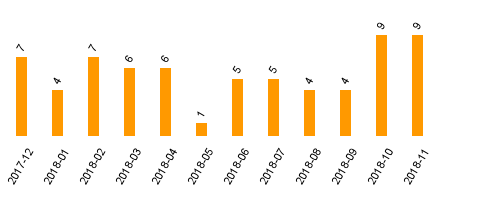

Zugriffsstatistik

(Anzahl Downloads)